Most concisely, private equity is the business of acquiring assets with a combination of debt and equity. It is sufficiently simple in theory to be frequently compared to the process of taking out a mortgage to buy a home, but intentionally obfuscated in practice to communicate a mastery of complex financial science. When encountered, the latter should be thought of largely as a marketing effort. Vocabulary aside, the process is simple. Incredibly detailed and at times chaotic, but not the product of financial wizardry.

- Private Equity Defined

- Comparison of an LBO Model to a Three-Statement Model (please see video)

- The Benefits of Leverage

The Benefits of Leverage: Debt + Equity

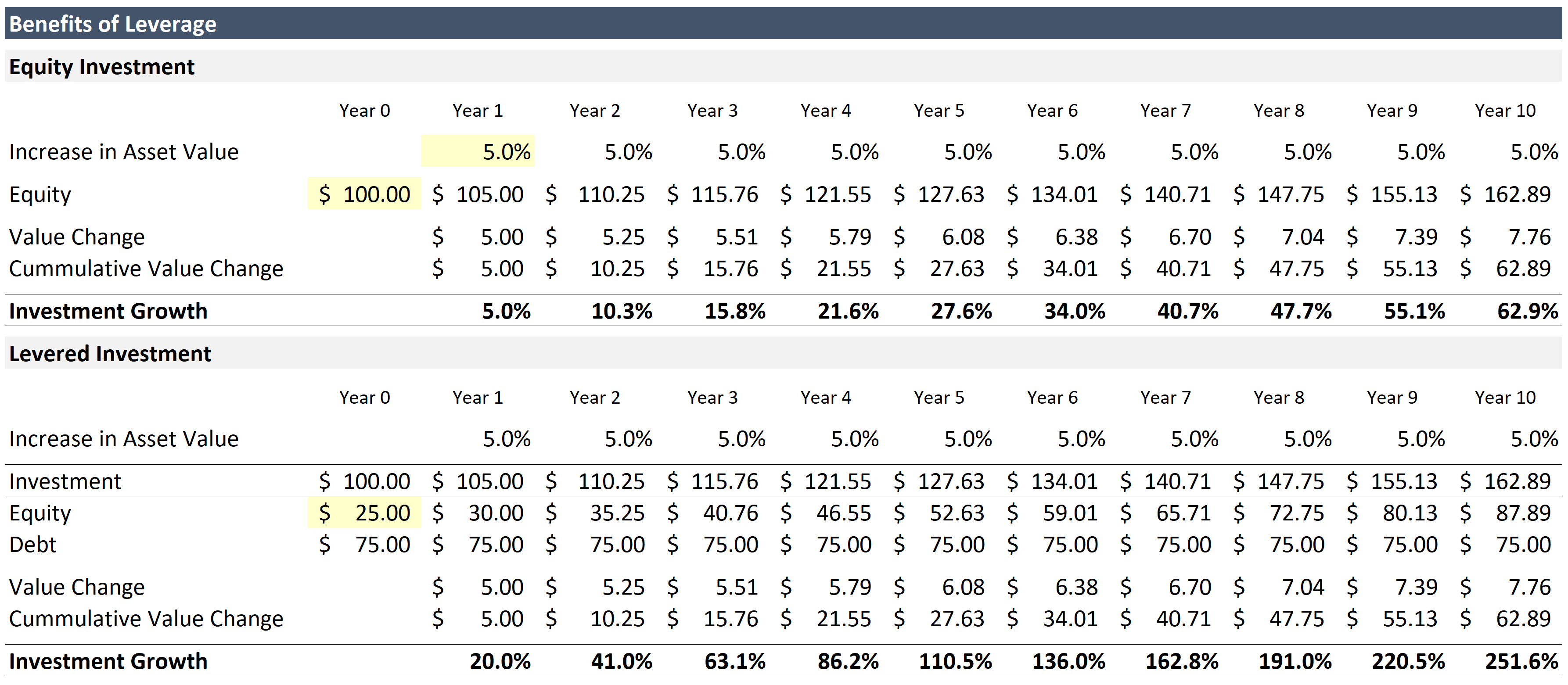

The benefits of leverage are easily captured by comparing identical investments that differ only in the amount of leverage employed. If the value of the asset grows over time, the amount of leverage used to acquire the asset will enhance the amount by which shareholder value grows. Think about the two terms as follows:

Debt is borrowed money that earns interest until it is repaid. There are two components to debt payments: interest and principal. Interest is the rate charged by the bank to loan capital to a borrower, and the rate is determined by the amount of risk assumed. Principal payments, which are defined by an amortization schedule, are payments made to reduce the balance of the loan. The final payment, known as the “balloon” payment, coincides with the maturity of the loan. For so long as the investment performs, and principal and interest payments remain current, the remaining principal balance for interest bearing debt will remain fixed. (This definition combines a lot of vocabulary. Future lessons will break this down to make concepts easier to grasp.)

Equity, on the other hand represents ownership. It is the value available to shareholder’s after all debts have been paid. It follows that as an asset increases in value, so does shareholder’s equity.

Per the table below, in both the Equity Investment Case and the Levered Investment Case, the shareholders own 100% of the same asset even though $100 and $25 of equity was used respectively to purchase it. In year one both investments grow in value by 5%, but a 5% increase on a $100 investment acquired with $75 dollars of debt causes the equity value to grow by 20%, which compares nicely to 5% growth in the unlevered example.

Note that the Value Change and the Cumulative Value Change are identical in both scenarios. The only variable contributing to the different return profiles is the amount of debt used to acquire the asset, which brings me to my next point. In this course we are exploring the acquisition of businesses with a history of positive cash flow. This cash flow can be used to further reduce the debt burden by paying it down over the course of the investment, which reduces interest expense and lowers the risk profile of the business. The terrific artistic rendering below, where E.V. stands for enterprise value, further demonstrates how this also benefits equity value.