Insights

IRR vs MOIC: A 200 Year Comparison

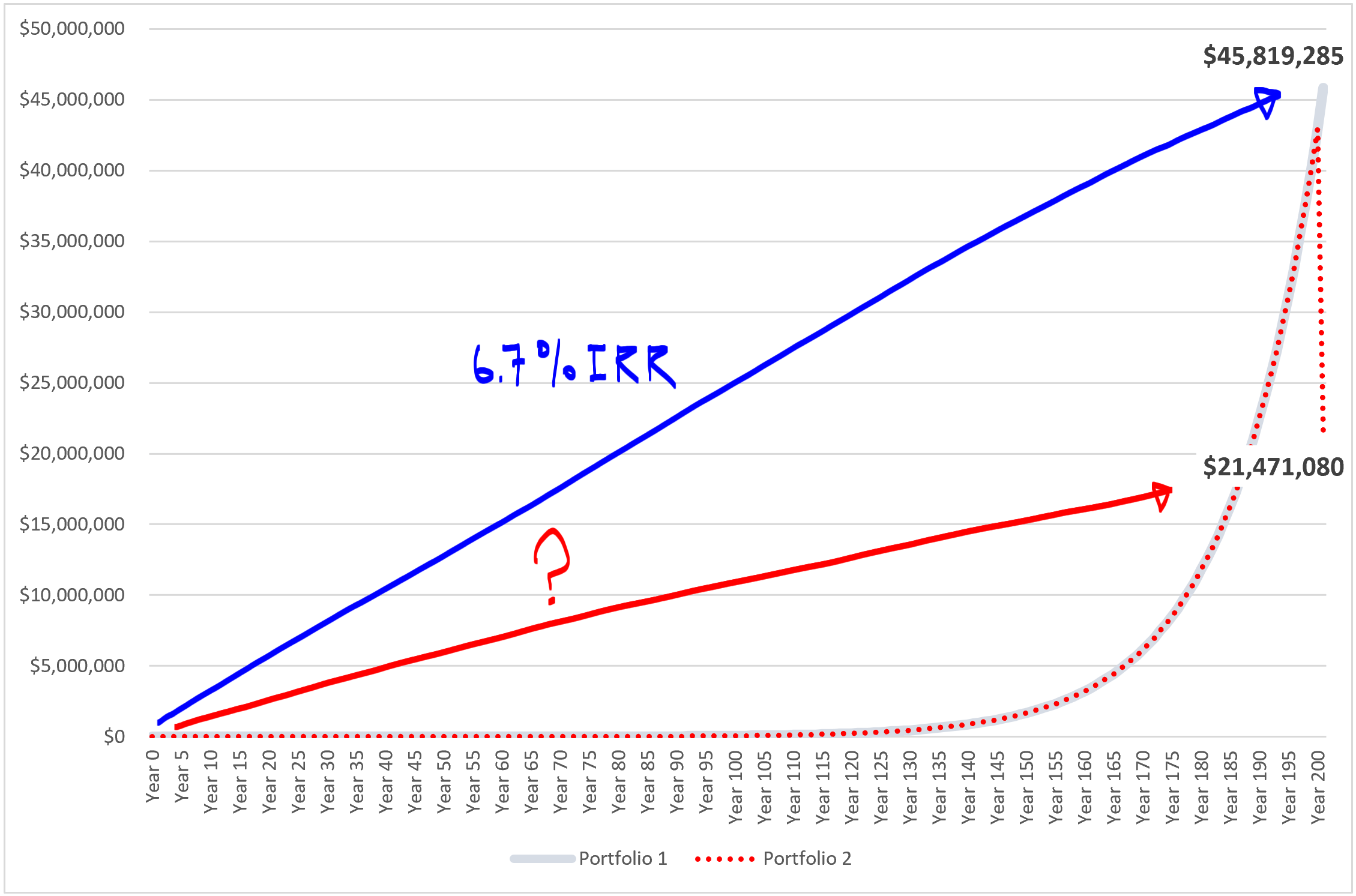

If an investment were to grow by precisely 6.7% each year for 200 years, and then lose half of its value in year 201, how would the investment record change?

An article by Jim Grant, one of my favorite financial writers and analysts, highlighted this excellent thought exercise which provides an entertaining way to explore the difference between the two most commonly cited measures of investment performance: the internal rate of return (IRR) and the multiple on invested capital (MOIC). From the article:

LBO Case Study & Financial Modeling Test

The LBO case study and financial modeling test are now live as part of the LBO Video Series. Please see the link that follows for the updated files: LBO Case Study: BabyBurgers LLC. The introductory video is also available below.

Evaluating Multiple Capital Structures in a LBO Model

Evaluating the appropriate capital structure for a particular acquisition is critical. In this post we will explore how to build a schedule to facilitate this process, and then demonstrate how to link this schedule to a LBO model.

Arrays in Excel Without Ctrl+Shift+Enter

I have always tried to use arrays in Excel without creating what is referred to as an “Array Formula.” An array formula is easily identified by the fact that you have to press Ctrl+Shift+Enter to create one, which is why they are sometimes referred to as CSE formulas. It has been my opinion that you can accomplish everything an array formula is capable of by nesting functions that create arrays in other functions.* The formulas this creates are more flexible, which makes building large models a little simpler.

Learn to Build a Private Equity Waterfall with 5 Videos

A series of videos explaining the most common distribution waterfall used in private equity is available below. (For a written explanation please click here.)