Insights

Becoming an Independent Sponsor

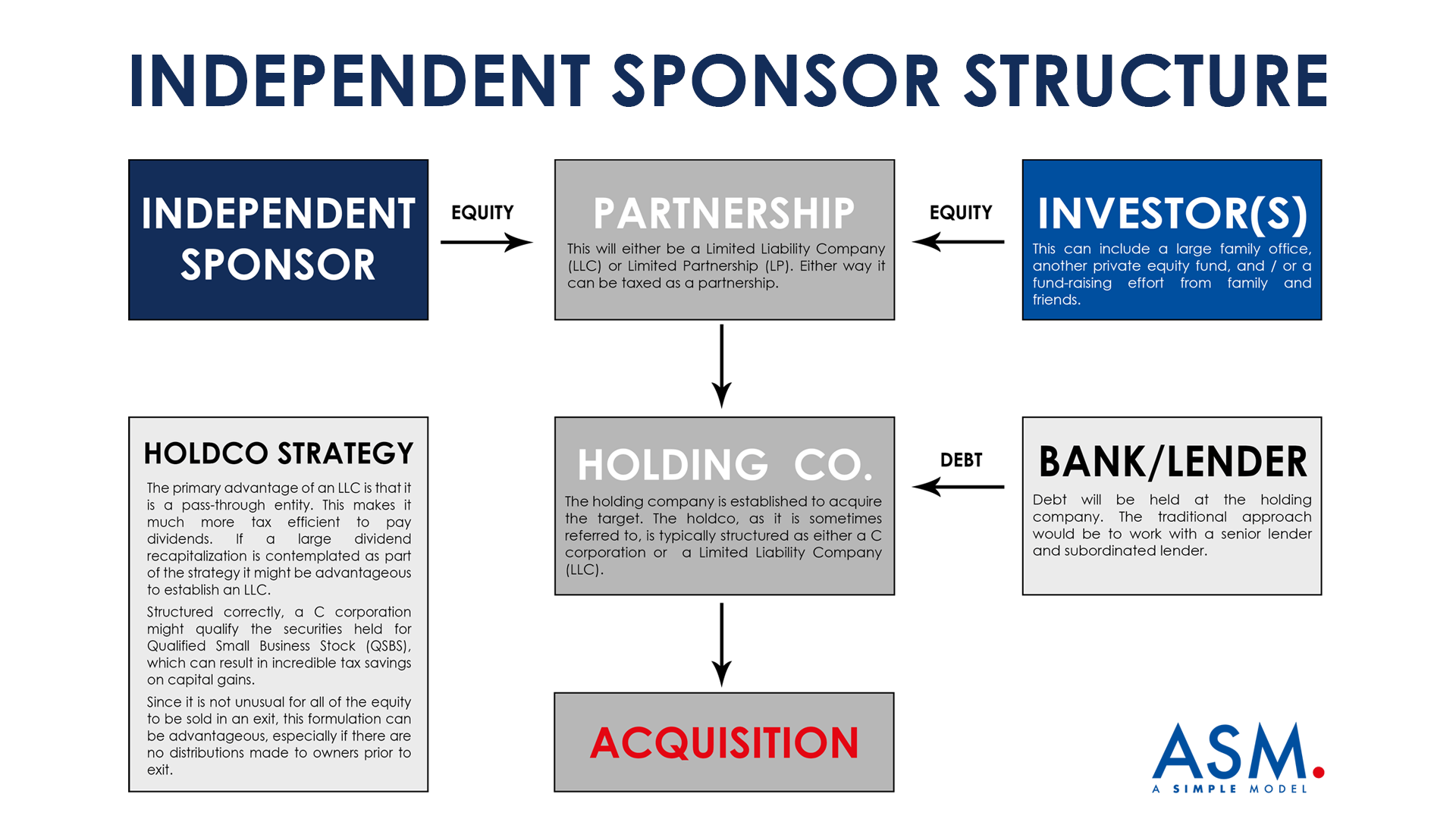

Last week I was lucky enough to interview Mason Barrett on his decision to set out as an independent sponsor. For those of you unfamiliar with this career track, Independent Sponsors pursue entrepreneurship through acquisition; his intention is to identify a company and raise capital to acquire it.

How to Get a Post-MBA Job in Private Equity

This interview is focused on getting a post-MBA or “partner track” job in private equity. My guest, Brett Lacher, has secured private equity jobs at the associate, senior associate and VP level. He also taught a course on the subject at Columbia University where he earned his MBA.

How to Become a CFO

Interested in the CFO role? I recently interviewed two talented individuals on what it takes to join the c-suite. Amazingly, under their leadership, both of the companies these two CFOs worked for grew from double digit millions of revenue to well over $1 billion of revenue. One company grew organically and the other largely via acquisition, which provides for two interesting perspectives.

Private Equity Fund Structure: GP and Management Company

Why does a private equity fund have both a general partner and a management company?

EBITDA Exit Multiple

An EBITDA multiple is, very simply, a company’s enterprise value (EV) divided by its EBITDA at a given time (EV / EBITDA); conversely, EV can be calculated by multiplying EBITDA by the EBITDA multiple. This metric has long been used as short-hand approach to a company’s valuation, and you will frequently hear individual deals or entire industries referred to as “an [X] times deal” or “an [X] times industry,” with X being a multiple of EBITDA.