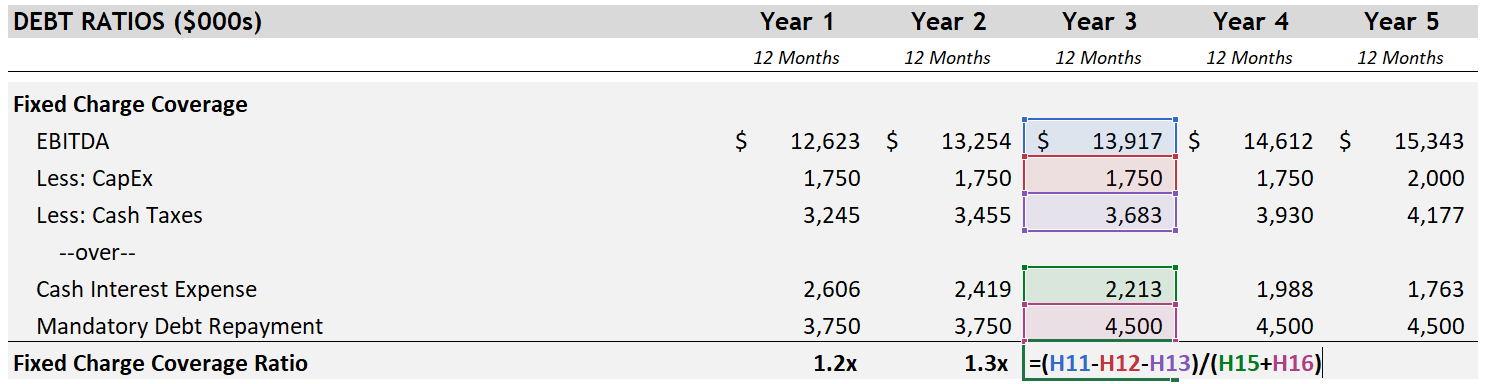

The fixed charge coverage ratio is used to measure a company’s ability to cover its “fixed charges” (largely debt-related payments but this can include additional obligations as you will see below) due in any given period. The definition provided here and elsewhere generally refers to “fixed charges,” which can be a little frustrating (akin to a dictionary defining “legendary” as “based on legends”). To clarify, we will start with a simple visual and expand on this by including the definition a senior lender might use in a term sheet.

- It is not uncommon to see capital expenditures described as “unfunded capital expenditures” in the credit agreement. If capital expenditures are “funded” it suggests that additional debt was used to purchase the equipment. The debt raised offsets the cash outflow, and the interest and principal payments associated with this new debt end up in the denominator.

- Mandatory Debt Repayment might also be referred to as Scheduled Debt Amortization. The purpose is to include only the scheduled principal payments described in the credit agreement. Any optional repayment of debt would be excluded as would any repayment of debt under a cash flow sweep.

- Finally, lease payments might also be included in the denominator with cash interest expense and debt repayment.