In the private equity world, due diligence is a crucial part of evaluating a company for a potential acquisition (Private Equity: Types of Due Diligence | A Simple Model). But to the business owner it can be an invasive and uncomfortable process.

This creates two problems.

1. If the business owner is only exploring their options, a PE team going into full diligence mode—with accountants, lawyers, technology experts, etc.—may overwhelm and turn them off.

2. If you’re not a PE firm but an independent sponsor just looking for a business to buy and run, then a full, multi-stage due diligence could be an unnecessary use of resources that you can’t afford.

For situations like these, I developed a streamlined due diligence checklist. If you represent a PE firm, it can get you to a trusting relationship with an owner who may not be committed to the full diligence process yet. And if you’re an independent sponsor, by prioritizing key areas it gives you the minimum you need to get to an LOI (offer) for most small-to-medium-sized firms.

Consider it a “lighter touch” approach to due diligence. By focusing on high-level financials, key operational metrics, and any major legal or regulatory issues, it uncovers the health of the business while being reasonably easy to execute. It will demonstrate confidence rather than skepticism and create a collaborative atmosphere with the owner, fostering rapport while signaling that you value their time and want them to feel comfortable and respected, not subjugated and scrutinized. This can open the owner to working with you even if the acquisition environment turns competitive. Hopefully, the end result will be not only a transition of ownership, but one that is amicable and a win-win for all.

As a final caveat, remember to be careful in your communication. If you present this list to an owner as a precursor to a fuller diligence, make sure they understand that if serious interest develops to move toward a close, you will need additional information at that point. And if you are submitting an LOI based only on this streamlined list, make sure the owner understands that the offer is based on the information received to date, and that any surfacing of contradictory information could affect that offer.

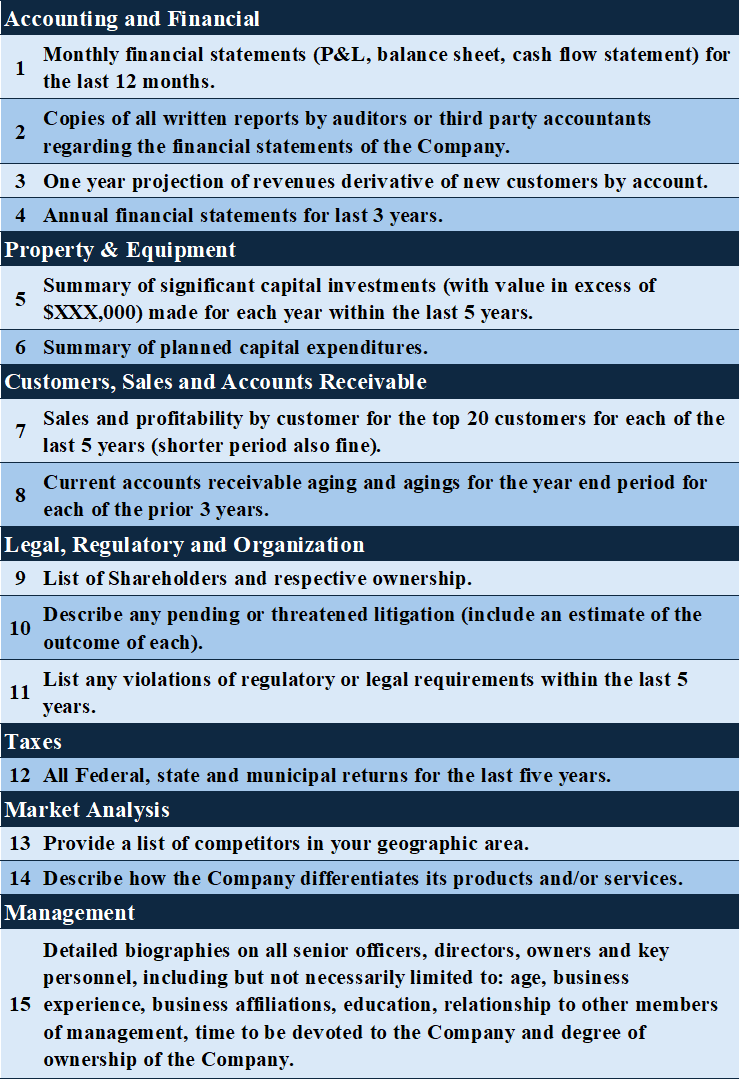

So, without further ado, the minimum due diligence list, fifteen points within seven categories: Preliminary Due Diligence_Excel Template_ASM Insights Page